Is GDP Growth A Good Predictor Of Stock Market Performance?

Conventional wisdom among investors today is that emerging markets represent a potentially lucrative opportunity for equity growth as compared to developed markets. The argument is that, because they did not participate in the excessive debt binge of the 1990s and 2000s, emerging market economies are poised to grow faster than those of developed countries like the U.S. While this is likely true, what does it tell us about the potential stock market performance in those countries? In short, not much.

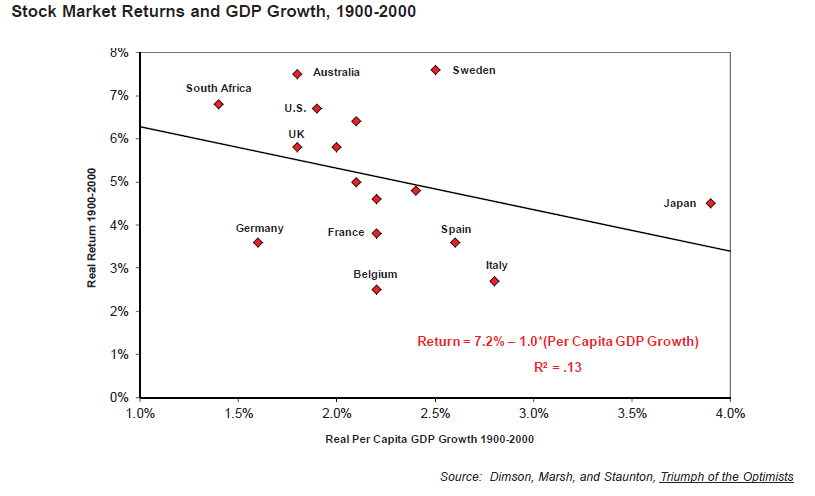

Ben Inker of GMO compared stock market returns to GDP growth across numerous countries since 1900 and found that there is no correlation between the two. See chart below.

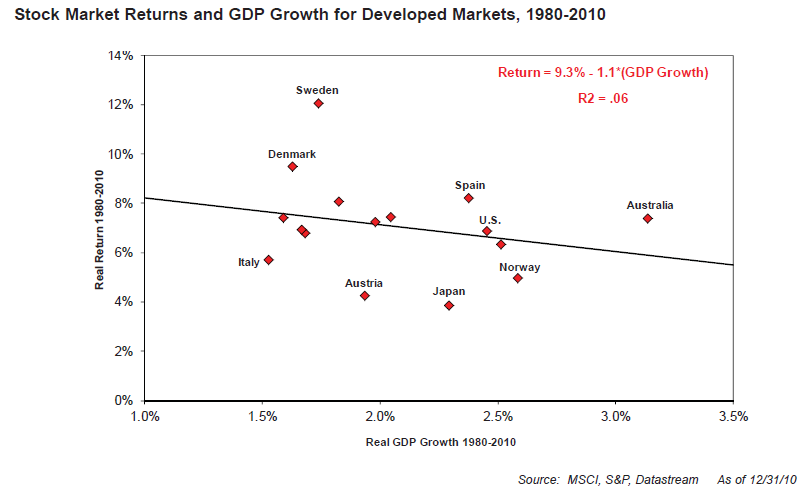

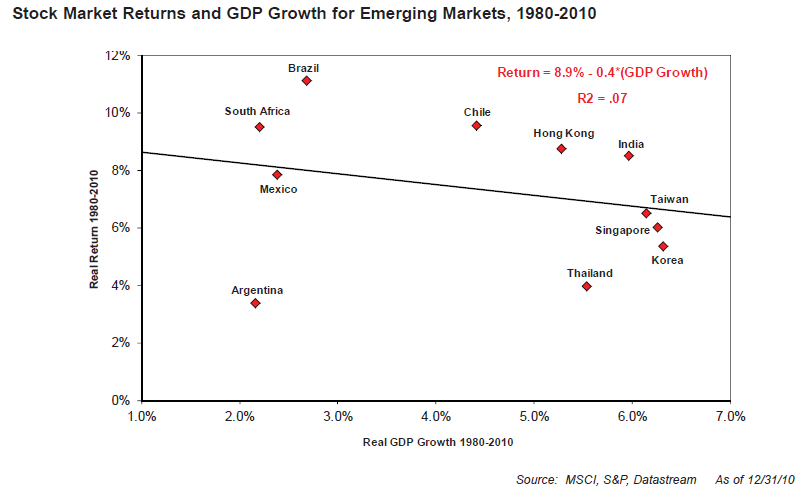

He even looked at developed countries and emerging countries in the past 30 years and found the same result:

How is this possible? Shouldn’t earnings grow with GDP and stock prices with earnings? Although aggregate corporate profits and overall market capitalization do in fact correlate with GDP, earnings per share (EPS) growth is affected by numerous other factors. And since market returns are comprised of dividends as well as EPS, they can even exceed GDP growth.

While a growing economy (as measured by GDP) certainly portends a healthier business climate, it does not necessarily translate into better returns on equity investments. Additional valuation methods should be considered before making investment decisions.