Five Myths About Bitcoins

First of all, what the heck are bitcoins? If you haven’t heard of them, they are one of a class of so-called digital currencies, mediums of exchange which are created and stored online, in contrast to ordinary paper and metal money. There are currently over 400 digital currencies in existence, with a total market value of $8.7 billion, according to coinmarketcap.com. Bitcoins represent about 90% of this total, making them the most popular of these alternative exchange mediums by far. There are currently 13.1 million bitcoins in circulation, each worth about $570. Although that may sound huge, as of June 2014 there was $11.4 trillion in official U.S. currency in circulation. So for every dollar out there, there’s less than a tenth of a cent’s worth of bitcoins additionally floating around. And that’s not even counting the additional trillions in yen, pounds, euros, yuan, etc. that comprise the world’s primary exchange currencies. Nonetheless, bitcoins have been gaining in popularity, with some mainstream stores such as Target, CVS, and Amazon now accepting payment in bitcoins. Clearly there’s interest in this new form of exchange. Is it time for you to start utilizing bitcoins? Here are five commonly accepted beliefs about bitcoins, and the reality behind each.

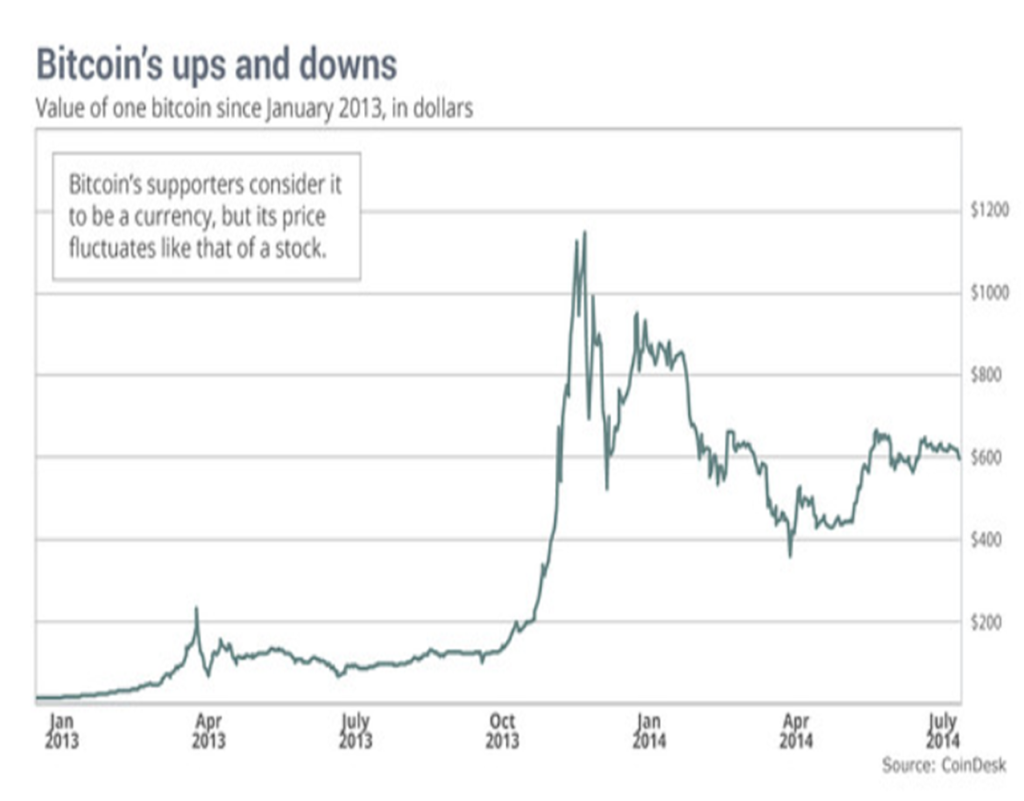

- Bitcoins are just like currency. In the sense that they are a medium of exchange for a limited set of products and services, that’s correct. However, the value of a bitcoin varies so much in value that any investment in one would have to be considered speculative at best. And imagine being a merchant pricing your products in bitcoins. You’d need to adjust your prices at least daily if not more frequently. (Is there a bitcoin arbitrage opportunity at Target?) See chart below for the change in the value of a bitcoin over the last year and a half:

- Bitcoins are safe. Bitcoins are converted to and from dollars through bitcoin exchanges. The largest, a company called Mt. Gox, announced last fall that a combination of a hacker attack and a software glitch caused it to lose 850,000 bitcoins. The company subsequently found 200,000 of the missing coins, but bitcoins worth almost $400 million remain unaccounted for. (In February of this year the company filed for bankruptcy). While one might consider this event as similar to a bank failure, it’s not. There are countless regulations protecting fiat (government-issued) currencies and the banks that exchange them, not the least of which are laws insuring assets, transitioning insolvent bank assets to other banks, and preventing counterfeiting (which can destroy the value of any currency). No such protections exist for bitcoins.

- There are no tax consequences to using bitcoins. Unfortunately, there are. The IRS considers bitcoins to be investments, and as such are subject to capital gains taxes. If you buy 10 bitcoins for $500 each, for example, and you later use the 10 bitcoins – after their value has gone up to $600 – to purchase some new appliances for your kitchen, you would not only be taxed on the purchase but also on the $1000 gain. What’s worse, the IRS hasn’t yet ruled on whether or not the investment would be considered a collectible, which would bump up the tax rate to 28%.

- There are no bank or exchange fees when using bitcoins. Proponents of virtual currencies say that they reduce transaction fees and create a level playing field for people without easy access to brick-and-mortar banks. Indeed, if you’ve ever had to exchange dollars into euros or yen, you will have discovered just how much of your money the bank ends up keeping as part of the transaction. Nonetheless, there are costs associated with buying & selling bitcoins, not to mention the additional cost of services – offered by numerous companies – to store bitcoins securely. Ironically some of these approaches involve converting passwords or other bitcoin attributes into paper, a concept completely counter to the idea of a digital currency.

- You are doing no harm by using bitcoins. While libertarians may relish the idea of a money system uncontrolled or monitored by a government, the fact is such systems are a boon for criminals. Early in 2013 federal officials shut down Liberty Reserve, a Costa Rica-based digital currency network that they accused of being primarily a criminal money laundering scam. And just last winter they closed one of the biggest online black market sites, Silk Road, which transacted drug and arms trading solely through the use of bitcoins. Since the shutdown, the value of a bitcoin has tumbled almost 40%, providing some indication of the level of demand for bitcoins that this one criminal enterprise had been generating.

What is the future of online digital currencies such as bitcoins? It’s hard to imagine governments with their own fiat currencies accepting bitcoins as an unregulated alternative currency. The most likely scenario is that countries that choose to accept them will impose regulations designed to increase safety and reduce their use by criminals. The result will inevitably be greater transaction costs and limits on anonymity. Such is the world in which we live. As for buying bitcoins today, all I can say is, “Caveat emptor!”