Should You Dollar Hedge Your Foreign Bonds?

A well-diversified investment portfolio should include some investment in bonds issued by foreign governments or companies. But it can be difficult (and expensive) to buy foreign bonds yourself. And there’s an additional risk associated with bonds denominated in foreign currencies that you don’t face when investing in U.S. bonds, namely currency risk. If the currency of the country from which you purchased the bonds drops in value relative to the U.S. dollar, any return from the bonds will be reduced by the same degree as the currency devaluation. Fortunately, there are ways around both these challenges. There are numerous mutual funds and ETFs here in the U.S. that invest in such bonds quite efficiently, making it fairly easy to add some to your portfolio. Some of those funds even try to eliminate currency risk through a process called dollar-hedging. But there are also many foreign bond funds that do not attempt to hedge against currency risk. Is it better to utilize a dollar-hedged foreign bond fund or to stick to those that allow currency fluctuations as part of their return?

First, a brief explanation of the way dollar hedging works. Suppose a dollar-hedged mutual fund wants to buy a ¥100,000 Japanese government bond that is worth $1000 at a current exchange rate of ¥100 = $1, and plans to hold it for one year. The most common way is to purchase both the bond (using $1000 converted to yen) together with a forward contract agreeing to sell ¥100,000 for U.S. dollars one year from now at today’s exchange rate. When the fund sells the bond the following year they simultaneously close out the forward contract, effectively eliminating any currency impact over the period. The net return will consequently be the actual return of the bond in yen, less the cost of the forward contract.

Although currency risk can reduce the returns you get from foreign bonds, it can also boost them when the bonds’ local currency strengthens against the dollar. So wouldn’t it be better to buy an unhedged foreign bond fund? I believe investors would be better served by utilizing dollar-hedged funds for a number of reasons.

- When you buy an unhedged foreign bond fund, you are investing in two different assets at the same time: foreign bonds and foreign currencies. If you want to invest in foreign currencies, it would make more sense to utilize funds that have the expertise to invest in that particular asset class, which functions in very different ways than do bonds.

- I am not a proponent of currency investments in general because of the difficulty of determining the expected return. A bond investment has a well-defined expected return based on its coupon and maturity. An investment in stocks is an investment in productive, growing companies (assuming a growing economy) with a consequent expectation of some positive return over time. But what is the expected return for currencies? Will the dollar grow by 5% per year versus the pound long-term? Or the yen? Over time currency investments have yielded close to a 0% average return. That’s not much basis for an investment.

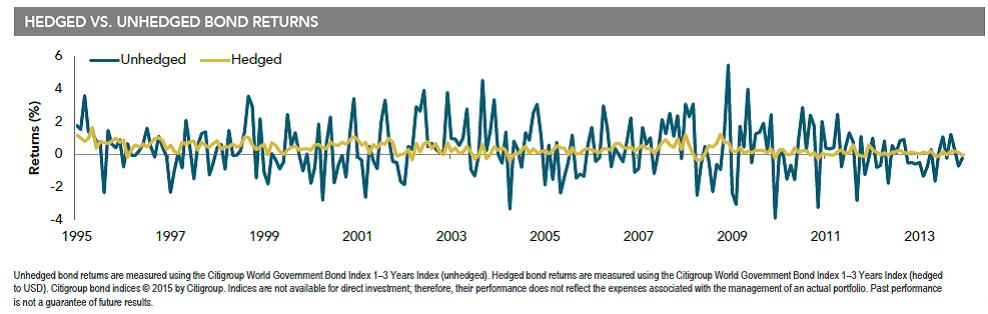

- The primary purpose of hedging is to reduce the risk and the volatility of an asset class. Because currency fluctuations are so much greater than bond price fluctuations, the returns of unhedged bonds demonstrate significantly more volatility than those that are hedged. The following chart from Dimensional Fund Advisors shows the Citigroup World Government Bond (ex USA) 1-3 Year Index from 1995 through 2013. You can see that the returns from the unhedged index were completely dominated by the currency movements. Dollar-hedging the index reduced its volatility from 5.3% to 1.7% annually, a significant improvement. And it even turned out that the average annual return from the hedged index (4.2%) was better than that of the unhedged index (3.6%) over the period.

Since bond investments in particular are supposed to provide more stability to a portfolio, it doesn’t make sense to me to leave all that currency risk embedded. Next time you are evaluating a foreign bond fund, I recommend considering one that utilizes dollar-hedging.