How Much Impact Do Presidents Have On The Stock Market?

As part of his bid for a second presidential term, one of Donald Trump’s assertions is that he is responsible for the greatest stock market gain of any president. Putting aside his usual hyperbole, has the stock market in fact done better under him than under past presidents? And more interestingly, can we use historical market performance data to infer whether or not there is any identifiable cause and effect between a president’s period in office and market performance?

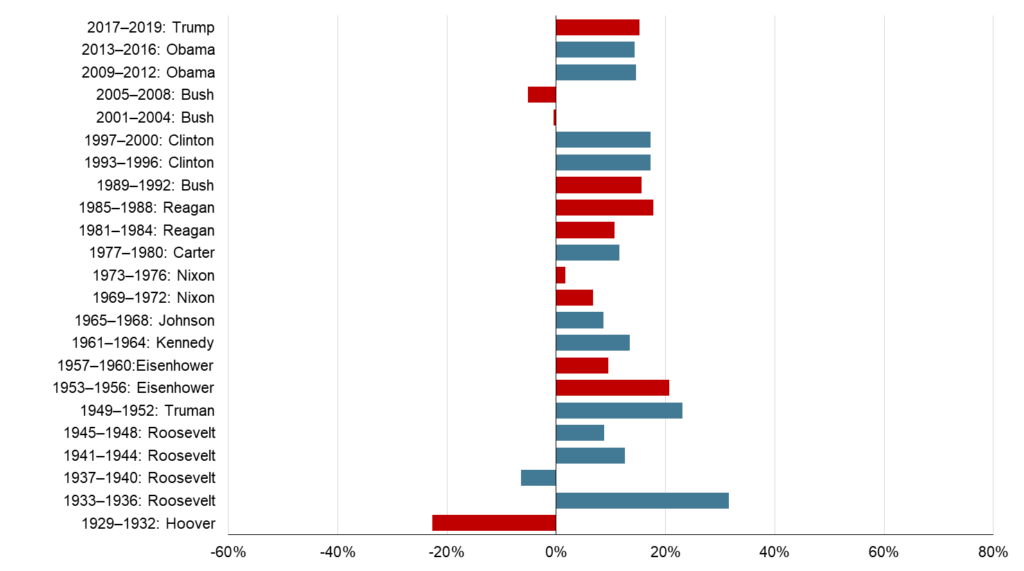

Below is a chart from Dimensional Fund Advisors showing the average return of the S&P 500 for each presidential term going back to 1929. In Trump’s case the data extends only through 2019, meaning that the impact of COVID on the stock market this year is completely excluded.

What can we infer from this data? First, Trump’s claim of market outperformance is – to borrow a phrase he is so fond of using – fake news. The S&P 500 performed slightly better under Trump than under Obama, but worse than under some of the terms of presidents Clinton, Reagan, Eisenhower, Truman, and Roosevelt.

Another fact: there were only two times when a presidential change coincided with a stock market turnaround. The first was when Roosevelt replaced Hoover, and the second when Obama replaced Bush. I use the word coincided because there’s no evidence that it was the new president that caused the market to shift as it did.

As far as the relationship between presidents and stock market performance, there’s nothing in the above data to suggest even any correlation between the two, let alone causation. But there is one fact that literally jumps out: the market declined during only four presidential terms out of the twenty-three spanning the last ninety years. And the average annual return over the entire period was over 10%. This serves to illustrate the value of long-term stock market investing in general regardless of which party’s president happens to be in power.