Is Trying To Time The Market Worth It? Part 2

A couple of months ago I wrote about the consequences of investing at stock market highs. Or rather the lack of consequences. See https://www.cognizantwealth.com/2020/10/20/is-trying-to-time-the-market-worth-it/. Here’s some additional data demonstrating why the fear of investing when stocks are highly valued is misplaced.

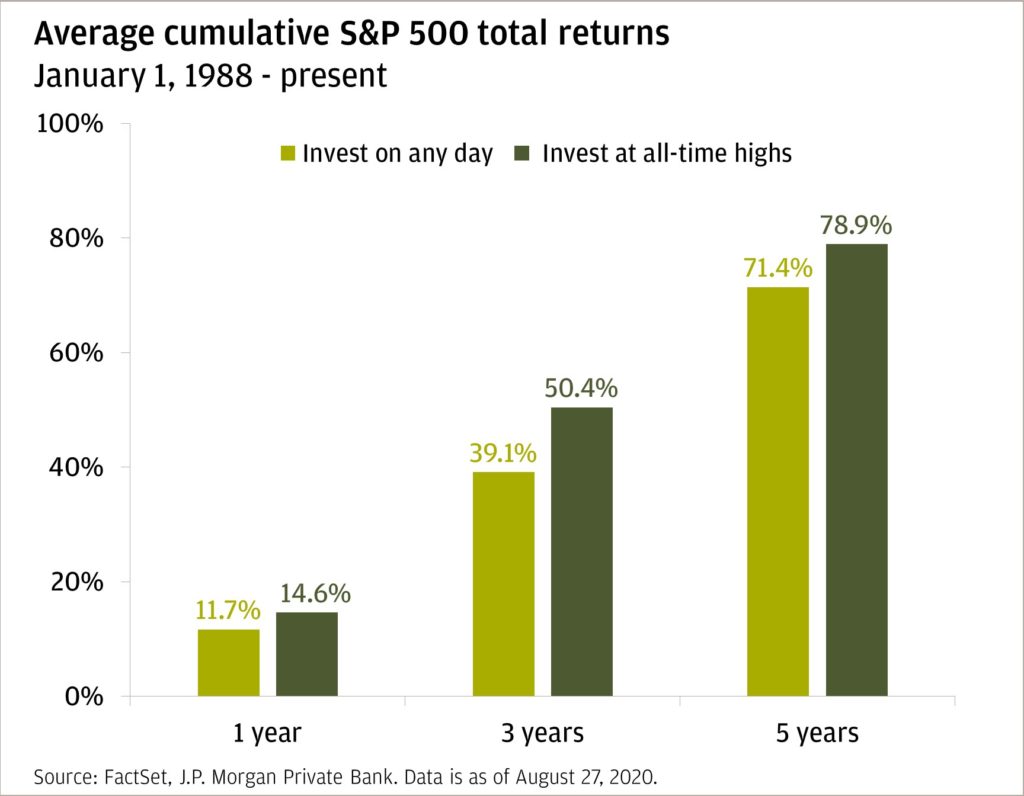

J.P. Morgan Wealth Management logged each of the days on which the S&P 500 reached new highs since January 1988. (Hint: there were well over 500 of them, resulting in over 15 new market highs occurring on average every year.) They then calculated the average of the one-year returns beginning each day over that period and compared that to the average of the one-year returns after only the market peak days. It turns out that the average one-year return after the peaks was actually greater than the average return across all days over the same period.

What about longer returns? J.P Morgan found that the result was the same for three-year and five-year cumulative returns. On average those who invested at the market tops would have done better than investors buying an S&P 500 fund on the other days. Here’s the chart:

Of course, this doesn’t mean that if you had invested at any particular peak you would have done better than having done so on any particular non-peak day. These are averages after all. But it does point out that there was certainly no discernable penalty for having invested on any day on which the market had reached a new high.

There have been extended periods – such as 2001 through 2007 – when the S&P 500 failed to set even one new record. But foreign emerging market stock returns left U.S. stock returns completely in the dust during that period. That’s the benefit of diversifying your investment portfolio.

It is always emotionally difficult to buy when stocks are perceived to be expensive. Learning to treat investing as part of a savings habit rather than as a short-term gamble may help to take the emotion out of the equation.

Here’s a link to the J.P. Morgan report: https://www.jpmorgan.com/wealth-management/wealth-partners/insights/top-market-takeaways-is-it-worth-considering-investing-at-all-time-highs.