Why Is Investing So Challenging These Days?

It wasn’t that long ago that people expected a common 60/40 investment portfolio (that is, 60% stocks and 40% bonds) to return close to 10% without a lot of volatility. Good luck getting that kind of return today. Why? It’s primarily because bond interest rates have hit their lowest point in generations and have remained there for an unexpectedly protracted period of time.

When we invest we are putting our money at risk in order to grow it. The proper way of investing is to determine the growth we need for our savings – taking into account our future goals such as college for our children, our desired retirement lifestyle, and anticipated inflation – and then try to achieve that level of growth with as little risk as possible. That risk/return balance was a lot easier to manage when interest rates were higher.

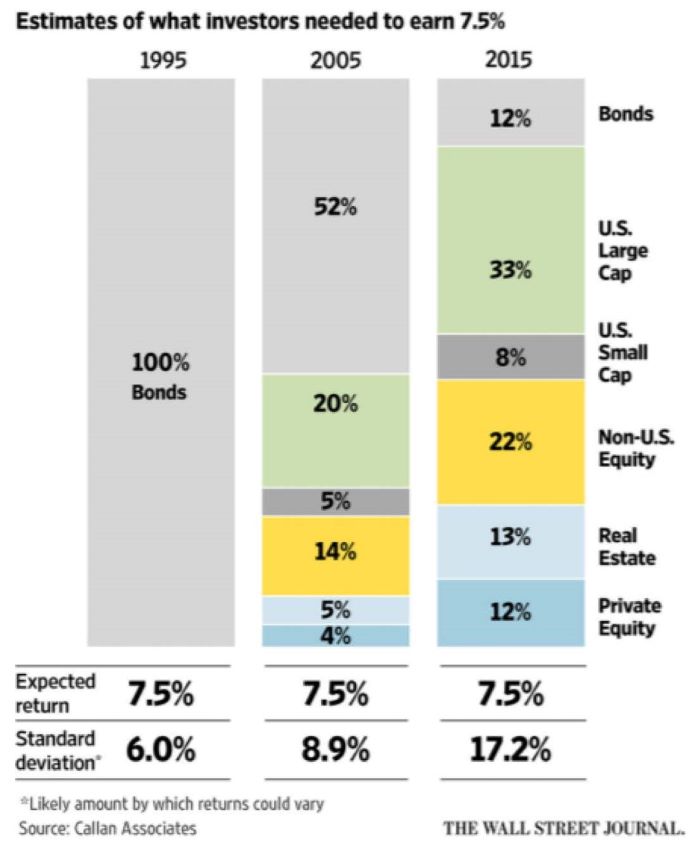

I came across the chart below from Callan LLC not too long ago. It points out how over only one generation (i.e. since 1995) the risk you have to take with your investments in order to achieve an annual 7.5% return has skyrocketed.

According to the chart, in 1995 you could have gotten a 7.5% return by investing almost exclusively in lower-risk bonds. The standard deviation is a measure of how much variation in returns you could expect from such an investment over multiple years. Statistically 6% means there’s about a two-thirds chance that each year’s actual return would fall between 7.5% plus 6% (13.5%) and 7.5% minus 6% (1.5%). While you might think that’s a pretty wide swing, that level of risk is considered relatively benign in the investment world.

Ten years later, with interest rates having fallen, it would have required taking almost half your savings and putting it into higher risk assets such as stocks and real estate in order to target the same 7.5% return. And by doing so you would have increased the standard deviation to 8.9%, meaning you faced a greater chance of higher gains (the good) or deeper losses (the bad).

By 2015 rates had fallen so low that investing in bonds would have returned only a pittance. Generating that 7.5% return would have required investing almost all your portfolio in high-risk assets. Unfortunately doing so would have resulted in a standard deviation almost double what it had been in the previous decade. The chances of losing money and being forced to give up on some of your future goals had subsequently become significantly greater.

Today rates remain as low as they were in 2015. Achieving a 7.5% average annual return today would still be a whole lot riskier than it was in 1995. Of course, there’s nothing sacrosanct about the particular allocations depicted in the chart. There are many ways of allocating your investment portfolio to appropriately balance its risk/return profile for your specific future goals. But the fact remains: expectations of future returns in today’s investment environment are much lower than they had been. And with the Federal Reserve intentionally keeping rates down to help stimulate the economy as a result of COVID, it could be some time before rates come back to a level that makes investing easier again.

One Response

Good stuff. Of course it’s important (although harder) to pay attention to your real (post-inflation) returns, not just your nominal returns (or change in your net worth). Also another consideration is having “enough” to worry less about long-term growth; “when you win the game, stop playing.” Personally I’ve pivoted to caring more about capital preservation than long-term growth.