How Big Has The US Wealth Disparity Become?

I came across some data from the Federal Reserve that compares the ownership of assets in the U.S. by wealth percentile (the top 1%, the next 10%, the next 40%, and the remaining 50%). To add some flavor we’ll name these cohorts the Elite, the Successful, the Middle Class, and the Working Poor.

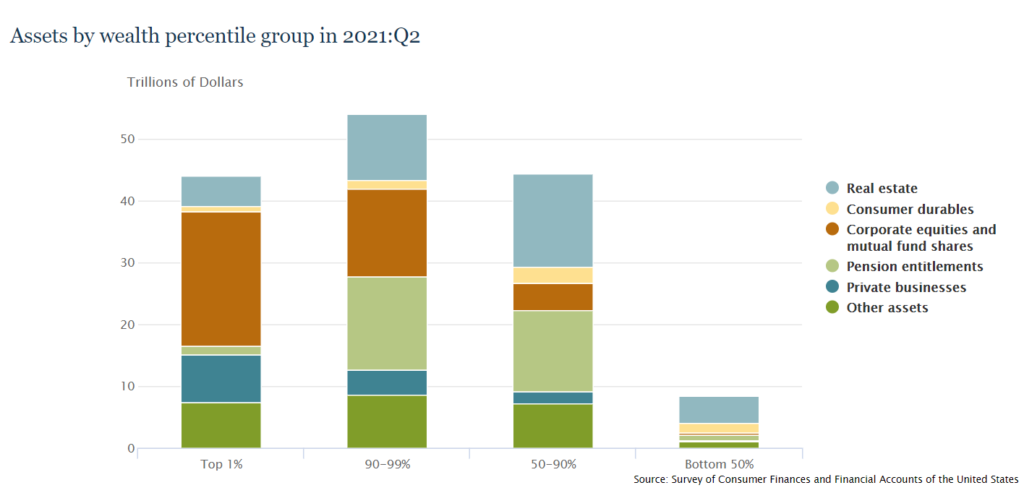

Here’s a chart showing the current breakdown:

What immediately jumped out at me: the wealthiest 10% of Americans (the Elite and the Successful combined) currently own 65% of all the country’s assets. And that disparity has been growing over time. Thirty years ago that same group owned only 55% of those assets. And most of their share increase came at the expense of the Middle Class (those in the 50%-90% cohort), whose share of total U.S. wealth shrank from 38% in 1991 to 29% today.

But relative shares do not tell the whole story. Everyone benefitted from the economic growth that the American economy generated during the last three decades. Even the poorest 50% of our citizens gained over $6.5 trillion of wealth over that period. But that’s nothing compared to the additional $84 trillion the Elite & Successful added to their coffers, far surpassing even the Middle Class with “merely” a $35 trillion gain.

How did they do it? The single asset class that drove the lion’s share of the growth at the top was corporate equities and mutual funds. From just $1.5 trillion in assets in 1990, the wealthiest two cohorts gained an astonishing $36 trillion over thirty years. And from the chart above you can see that today they hold over 75% of all the financial assets.

Interestingly the growth in real estate fueled most of the Middle Class and Working Poor’s wealth since 1990, suggesting that governmental policy supporting homeownership did help at least our less fortunate citizens.

I worry about the growing wealth disparity in our country. History suggests that when a large enough segment of a population feels disenfranchised, unrest and political upheaval tend to follow. On the positive side, the capital market assets that have fueled most of the growth are much more accessible even to less wealthy individuals today. But according to analytics firm Gallup, as of July 2021 less than 50% of less educated, lower income, and Black & Hispanic adult cohorts (to name a few) currently own stocks. Clearly more education is needed to help these groups learn about and take advantage of the wealth-building benefits that the stock market offers. Society as a whole benefits when we all get to share in our country’s growth.