Will Tech Stocks Keep Growing?

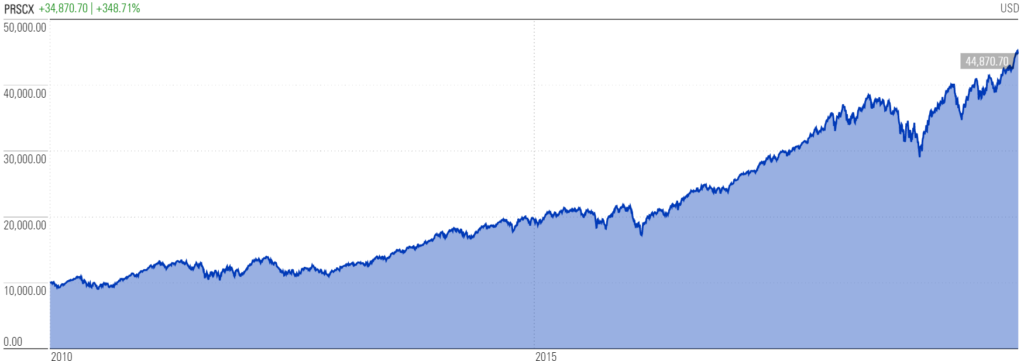

The technology sector of the U.S. stock market has been on a tear. During the last decade the T. Rowe Price Science & Technology mutual fund (which I will use as a proxy to represent the sector) rose over 300% (see chart below).

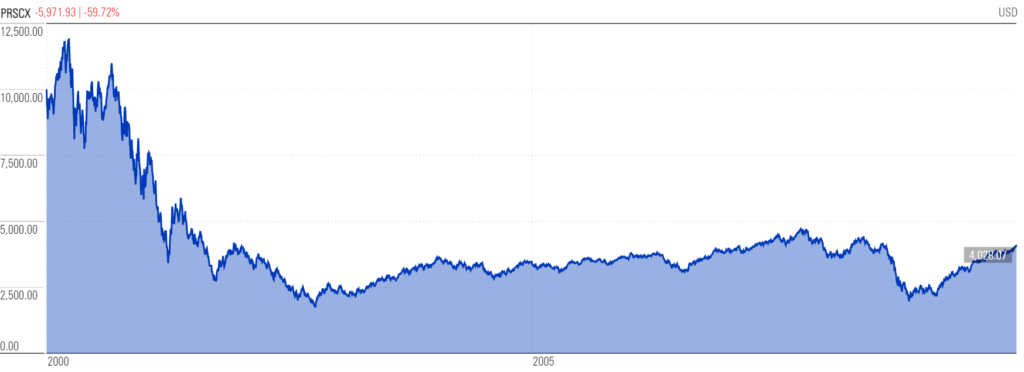

Younger investors who started buying stocks or mutual funds less than ten years ago might be forgiven for believing that the place to plow all their savings is in technology companies. After all, those companies have generated the best returns over those investors’ entire investment lifetimes. But investors of any age should always be careful of tunnel vision. If you look at the decade before last you’ll discover that tech stocks were among the worst places to invest. The same technology fund declined almost 60% during that period (see chart below) and significantly underperformed the broader S&P 500 (which lost only 2.7%).

The key takeaway from this data is quite simple. There’s no evidence that the trend in any company’s stock performance at any point in time will continue forever. After rising over 150% in 1999, Apple stock dropped 70% in 2000. General Electric dropped 50% in 2017 and again in 2018 after having doubled over the previous five years. Price/Earnings ratios of 300 plus for companies such as Tesla are just not sustainable. It’s impossible to say when the current boom in tech stocks will end. But at some point it will, if only because investors become less willing to pay such high prices for stock ownership. If you are significantly invested in technology stocks and want to avoid the pain of larger losses when concentrated investments turn negative, you should consider broadening your investment horizon. Tech stocks are not the only game in town.