Is Active Management Better During Downturns?

There are two ways mutual funds can be managed. Actively-managed funds are those whose management teams attempt to generate a better return than the average return produced by the asset class in which the fund invests. Passively-managed funds simply try to achieve the average return. Because active funds require more analysts and/or complex software algorithms in order to try to beat the averages, their costs are invariably higher than the latter funds, which consequently reduces the net returns to their investors. That’s typically a big hurdle to overcome.

My position on active vs. passive is well-known to readers of this blog. For fixed income assets, active management can and often does result in outperformance. But the only way to outperform the average return of any equity asset class is to somehow pick just those stocks that outperform or to successfully time the market’s ups and downs. There is no evidence that anyone has been able to effectively and consistently do that.

One of the myths around active management of stocks is that is does better during downturns. Even the CEO of Franklin Templeton Investments, Jenny Johnson, asserted just that in a recent interview on CNBC. “Anytime you have this kind of uncertainty, this is the time that active managers thrive,” she said. “Now, we’re really seeing the real companies that have … good value, stable balance sheets, … and so I think this is when you want to be doing in-depth research and deciding who can withstand … a choppy period.”

Over the past decade stock asset classes had performed extremely well as the economy has grown, with passive funds trouncing active ones. What better time to test this myth than right now, with the stock market experiencing its worst year since 2008.

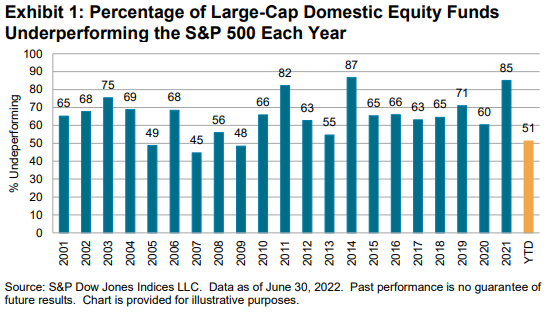

Below is a chart from S&P Dow Jones Indices showing the percentage of large-cap funds that underperformed the S&P 500 during the first half of 2022 and going back to 2001.

Johnson was correct that actively-managed funds did better this year as well as during the 2008 recession as compared to other years. But thrived? During 2007, the best year for such funds over the past twenty, barely more than half were able to beat the S&P 500 average. From the chart it can be seen that most years only about a third of funds outperformed the market. And according to Dimensional Fund Advisors, active funds that outperform in one year rarely do so consistently over five or ten years. Good luck trying to identify the winners in advance.

Is there any way to invest such that you can achieve good returns during growth years and avoid big losses during the downturns? Yes! It’s called diversification. And when it comes to the equity asset classes, if you stick to passive ones rather than the pricier active ones, you are more likely to get better returns over time. Just look at the data.