Can AI Be Used to Pick Winning Stocks?

Artificial intelligence (AI) is all the rage these days. Ever since ChatGPT was introduced by OpenAI and Microsoft, companies are falling over each other to find ways to apply AI to all kinds of activities. You may not recall it but IBM was actually one of the pioneers of AI. They designed a chess-playing computer system that in 1997 was able to beat world chess champion Garry Kasparov. That accomplishment led to the creation of a more advanced system they named Watson in honor of the company’s founder. Watson had been developed to answer natural language questions on the TV quiz show “Jeopardy.” In 2011 it was matched against Ken Jennings and Brad Rutter, two of the winningest players in the show’s history. Watson beat them both and won one million dollars.

Since that time Watson’s AI capabilities have been implemented in numerous fields including healthcare and business processes. It was only a matter of time before someone decided to apply it to stock picking. In 2017 an ETF (ticker symbol AIEQ) was introduced by technology company EquBot that utilizes Watson to analyze publicly available information in an attempt to pick stocks that will outperform the broad U.S. stock market.

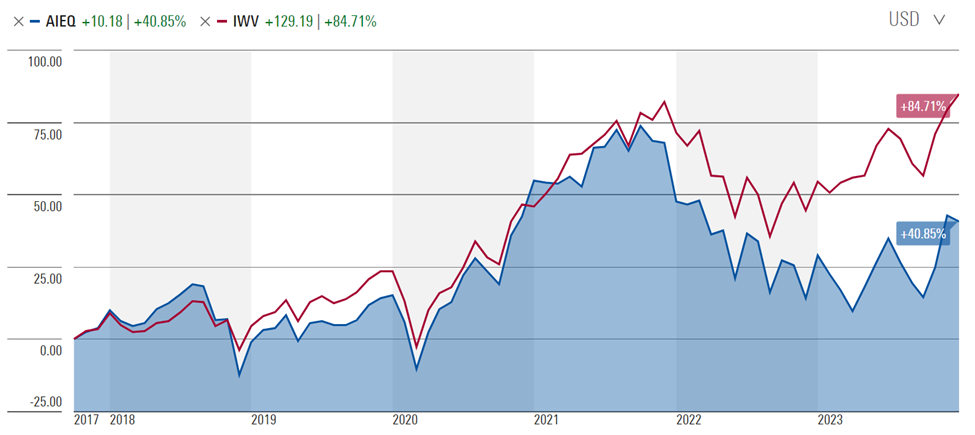

How well has it worked? Here is a chart comparing AIEQ’s return as of this writing since inception with the return of a Russell 3000 index ETF (representing all U.S. publicly-traded stocks):

As you can see, you would have made more than twice as much by investing in the broad market ETF rather than in the AI ETF over that period of time.

This result does not prove that it’s impossible to use AI to be able to pick winning stocks. After all, this is just one implementation example. But since no human has ever been able to do it with any degree of consistency so far, I would think that AI would need to progress at least several generations to even have some hope of achieving this long-sought goal.

In the meantime the rest of us mortals still have index funds to invest in.