Worried About The Election’s Impact On The Stock Market?

I have heard from several clients about how worried they are regarding the upcoming presidential election. I won’t delve into the politics; you can draw your own conclusions as to the consequences of one or the other candidate’s getting into or remaining in power. But as far as the stock market is concerned, I don’t see any need for anxiety.

I first wrote about this during the 2020 election (see https://www.cognizantwealth.com/2020/10/06/how-much-impact-do-presidents-have-on-the-stock-market/). To reiterate: there is no demonstrable correlation between presidents and stock market performance. Equities have had positive returns under both Democratic as well as Republican administrations in 13 out of the 16 presidential terms spanning the past ninety years. That makes sense when you consider that equity performance is basically a direct outcome of the performance of the publicly-traded companies comprising the market. It has nothing to do with politics. When company profits rise the prices of their stocks generally do the same and vice-versa.

I have heard some people express the opinion that Republicans are pro-business and Democrats are pro-consumer and anti-business, suggesting that the economy is likely to do better under Republican administrations. You can easily find the average annual GDP growth under each President since Herbert Hoover (see https://www.investopedia.com/gdp-growth-by-president-8604042). I can see no obvious correlation between political party and economic growth. In fact there’s a study that found just the opposite. Alan Blinder and Mark Watson in the American Economic Review assert that “the US economy has performed better when the president of the United States is a Democrat rather than a Republican.” (See https://www.aeaweb.org/articles?id=10.1257/aer.20140913).

But that’s all beside the point. Stock market returns are not directly linked to GDP or any other economic metric. Obviously when the economy goes into recession, business profits decline and stock prices follow suit. But investors are constantly looking forward, so stock market returns are unlikely to match economic performance measures at any point in time. Recognize also that most of the S&P 500 companies are multi-national. According to the St. Louis Trust over 40% of their revenue comes from overseas. So American companies (and their stock prices) should likely get a further boost when global trade increases.

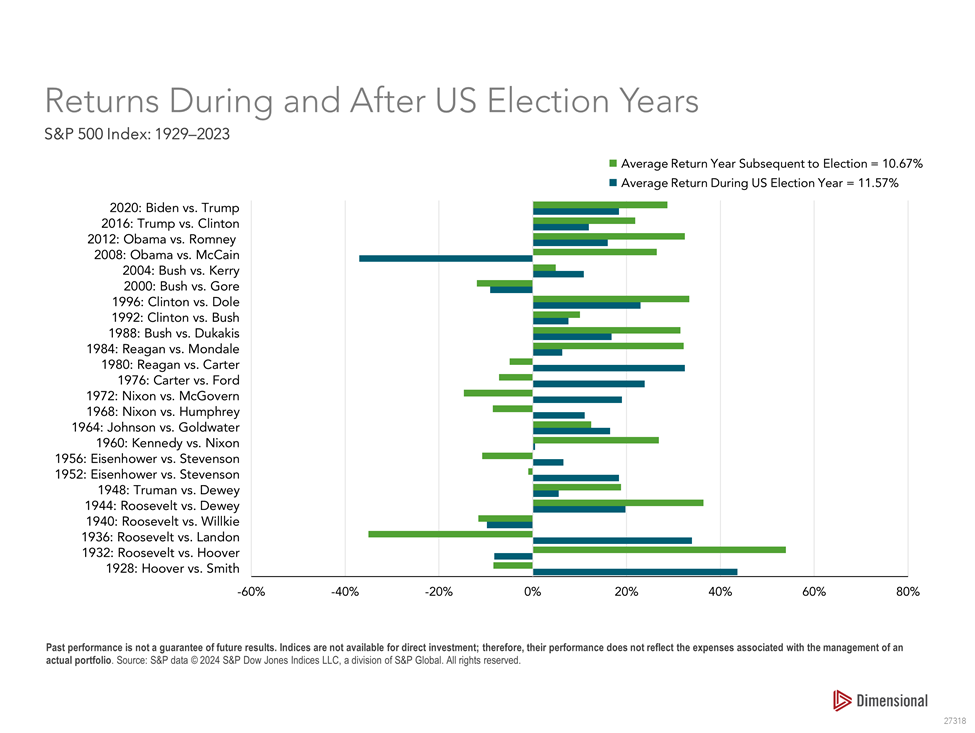

How does the market perform during presidential election years? Here’s a chart from Dimensional Fund Advisors showing the S&P 500 return from every presidential election year since 1928 (in blue) and its return the following year (in green). The average return during election years was over 11% and there were only four times when the market had a loss. Regarding the subsequent year, while the average return was slightly lower, more than half the time the S&P 500 had higher gains. And that was under both Republicans and Democrats.

So to those who are worrying about who our next President might be, one thing you shouldn’t have to be concerned about is what will happen to your investments. My advice: don’t do anything. Presidents will come and go, but a well-managed investment strategy should help you successfully navigate whatever they do.