Is Inflation Bad For Stocks?

Although inflation has been mitigated over the last couple of years, it’s still on the minds of many investors. Should we avoid stocks when inflation is high? Can inflation be used for market timing in some way?

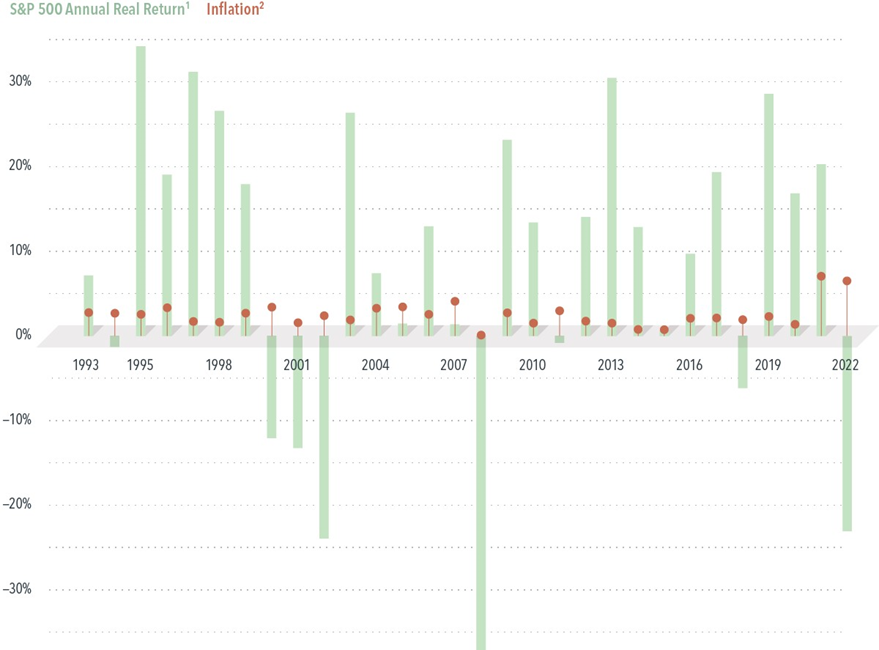

Unfortunately the answer is “no” in both cases. There is no demonstrable connection between periods of high inflation and stock market performance. Here’s a chart from Dimensional Fund Advisors that compares the annual real return (that is, return above inflation) of the S&P 500 with the 12-month percentage change in the Consumer Price Index for All Urban Consumers (CPI-U).

There are a couple of learnings we can glean from this. First, why focus on real returns? Because when saving for the future, it’s critical to ensure that your savings at least keep pace with the cost inflation of the products or services that you’re saving for. How many times have we heard about organizations that – after having initially estimated the cost of some project – found that the cost had significantly increased afterwards because they waited too long before starting work? Inflation is not always high but it’s rarely negative or even zero.

What about the original question? As you can see from the chart there is no correlation between returns and the inflation rate. In fact the worst stock market performance over the past 30 years (2008) occurred when inflation was low. Neither inflation (nor any other factor for that matter) has been shown to have any predictive power for market returns.

We can also see from the chart that since 1993 annual returns have been below inflation only 30% of the time. And the average annual real return of the S&P 500 over that period was 7.0%. Interestingly the annualized inflation-adjusted return on stocks going all the way back to 1926 was also 7.0%. History shows that stocks tend to outpace inflation over the long term. That’s one of the primary reasons we invest in stocks: because they are one of the best inflation hedges available for our savings.